Webinar replay | Global Supply Chain Architecture: Examining Red Sea’s Evolving Impact - Watch Now

5 reasons why companies need to speed up their emission reduction efforts

Companies that take proactive steps to address the challenge of climate change by embedding sustainability in their operations will not only be better protected from potential risks, but will also gain a competitive advantage as the market increasingly views decarbonization as a business-critical issue.

The benefits of effectively measuring and publicly reporting on their greenhouse gas (GHG) emissions across the supply chain, and taking action to decarbonize operations, extend to all aspects of the business.

1. Meeting individual and collective demands for climate action

A strong trend is emerging among individual consumers, business customers and investors to align with businesses that are prioritizing sustainability.

At a consumer level, a 2022 Deloitte survey found that 34% of U.K. consumers stopped purchasing certain brands or products because they had ethical or sustainability-related concerns about them. The pressure for companies to report and provide decarbonization plans also comes from customers. In 2022, over 280 major buyers with $6.4 trillion USD in procurement spend requested thousands of suppliers to disclose their GHG emissions and management strategies through the Climate Disclosure Project (CDP).

Meanwhile, any organization that trades publicly is now subject to a set of standards that socially conscious investors use to screen potential investments. These standards qualify a company’s behavior across environmental, social, and governance (ESG) criteria.

To give some perspective on the scale of the interest in these ESG indicators, in 2022, over 680 investors with US $130 trillion in assets requested thousands of companies to disclose through the CDP.

2. Ensuring compliance with international climate legislations

The European Green Deal and the Fit for 55 strategies made legally binding Europe’s targets to become net zero by 2050 and to have reduced its carbon footprint by 55% by 2030.

The carbon reduction targets that flow from this legislation will focus first on the sectors with the greatest GHG emissions. Since freight logistics is one of the eight supply chains that account for over 50% of global emissions, it will come under mounting legislative pressure to decarbonize at pace.

Meanwhile, industries are setting their own decarbonization goals and levers. For example, the International Maritime Organization’s IMO 2023 made it mandatory for all ships to measure their energy efficiency and to initiate the collection of data for the reporting of their annual operational carbon intensity indicator (CII) and CII rating from 1 January 2023.

Europe’s Emission Trading System (ETS) which has previously applied to air freight will be extended to include international shipping in 2024, helping to finance decarbonization initiatives.

Starting the decarbonization journey promptly will future-proof businesses, reducing the cost of compliance with future legislation while ensuring conformity with the current mandatory GHG reporting programs.

From 2023 onwards, France is the first country to include Scope 3 emissions in their mandatory GHG reporting, and others will soon follow their lead.

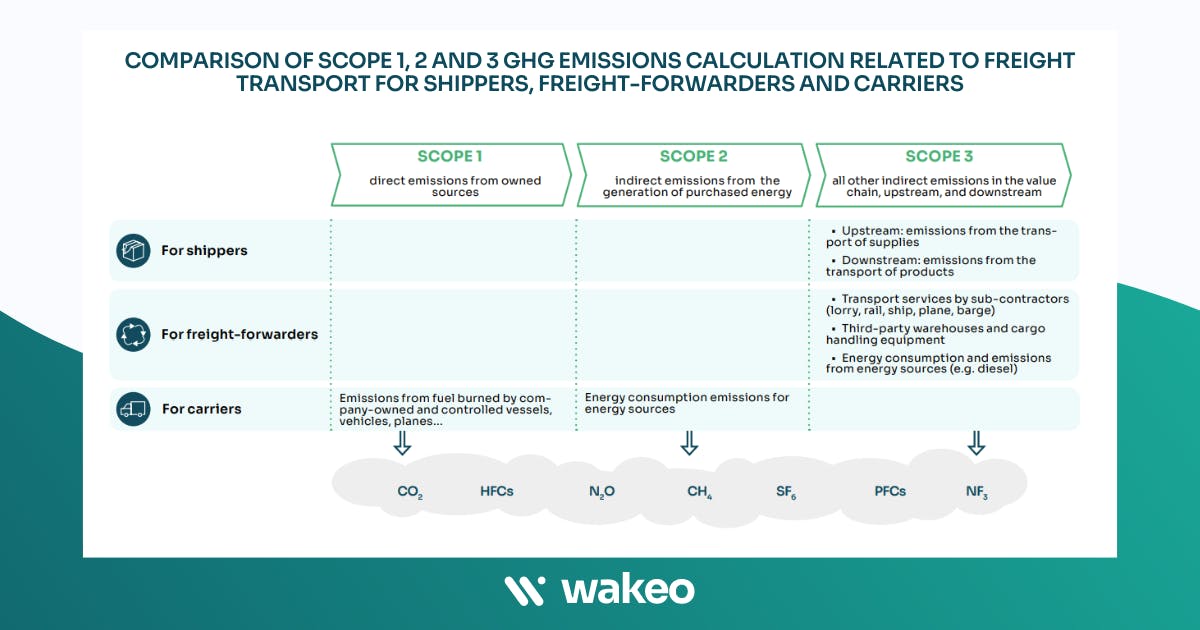

The GHG Protocol Corporate Accounting and Reporting Standard classifies the carbon footprint into three ‘scopes’. This diagram outlines the emissions and their respective scopes that relate to freight transportation. Transportation emissions are scope 1 for carriers, and scope 3 for freight-forwarders and shippers. Scope 3 emissions can be difficult to measure as they include Tier 1+N carriers within the transport supply chain. There is often a lack of visibility of GHG emissions from these suppliers.

3. Becoming more resilient and de-risking for the long-term

Decarbonized supply chains can benefit from being more resilient against disruption, and businesses may ultimately benefit from lower operating costs and reduced fuel price volatility. Improved fuel efficiency reduces a carrier’s exposure to fluctuating oil prices, and reduced consumption of fossil fuels can offer protection against escalating prices.

In addition, the manufacture of zero carbon fuels such as hydrogen is more geographically diverse than that of fossil fuels. Such availability and geographic independence should result in a competitive landscape that lowers costs over the long-term. As the conflict in Ukraine has highlighted, fuel prices can be subject to considerable short-term price rises, even before governmental net zero targets are brought into force.

4. Securing your place in the new landscape of sustainability competitiveness

Many logistics companies have pledged to decarbonize their operations by 2050, with a growing number setting more ambitious targets to achieve net zero by 2040. Meanwhile, the number of companies disclosing their emissions has grown to represent more than 50% of global market capitalization. In contrast, failure to act on decarbonization will soon see companies being left behind their competitors.

“72% of CEOs say sustainability is a priority as they deal with the fallout of the COVID pandemic.” - UN Global Compact CEO study.

Decarbonization will become increasingly important to maintain customer loyalty and foster a positive brand image, and logistics companies that offer low-emission services will stand to benefit.

Businesses that provide greater transparency to their customers of the real-world GHG emissions of each shipment will also find themselves at an advantage, as this data moves from being something that customers see as a “nice to have” to becoming business critical.

The market is moving, and fast. The companies that are first to launch climate-friendly services will find themselves perfectly situated to reap the opportunities that come from this.

5. Mitigating the threats of inaction

While there are a host of benefits to acting fast on decarbonization, there are also several pressing threats to businesses of inaction.

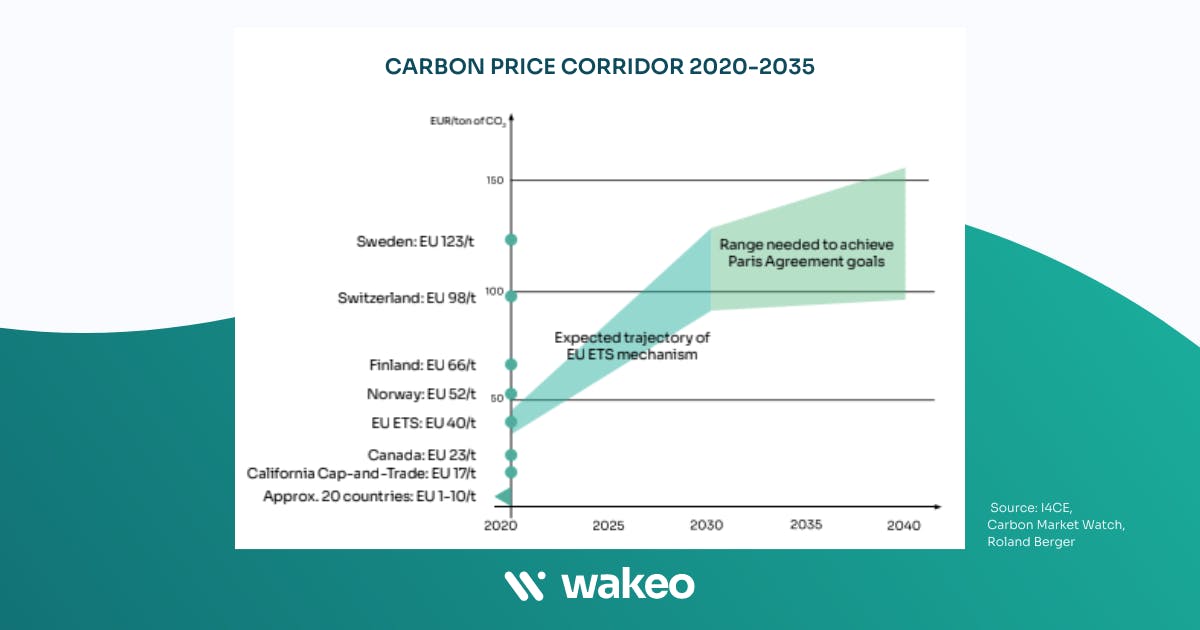

As the price of carbon increases, businesses that are powered by fossil fuels will face considerable hits to their profits. A study by Reuters and Roland Berger found that transport businesses could risk over 50% of their profits with an assumed carbon price of EUR 100/t.

Meanwhile, the evidence is clear that the current impacts of climate change are already creating negative effects for the freight transport industry, from infrastructure damage to increased claims on broker bonds and insurance. These effects will amplify if global temperatures continue to rise, with critical transportation infrastructure, fleets, and their cargo all vulnerable to the damage caused by resulting extreme weather events.

Political instability due to climate change will also pose a serious threat to the seamless cross-border transportation that international logistics needs to operate efficiently.

The costs that organizations will have to pay to mitigate these climate impacts will be far higher in the future, with far greater threats to all actors in global freight transport and the world at large, if we do not act with urgency today.